Our third blog in our series focusing on the individual ESG elements details the last character “G” which stands for Governance. The Governance segment encompasses ownership and structural transparency, shareholder rights, board of directors’ independence and oversight, diversity, data transparency, business ethics, and executive compensation fairness. This also applies to the broader corporate governance policies and practices that a company has put in place.

A lot has happened in the ESG arena over the past few years and the momentum behind the sustainability initiative and reporting continues to intensify rapidly. Several moves by regulators from late 2020 through 2021 may have brought ESG reporting to the point of no return. To date, ESG reporting has been voluntary and focused primarily on communicating aspirations while providing some data to support or help tell the story, however with recent developments there could be more stringent regulations and reporting is taking shape that would include auditable sustainability standards. This could actually be the year that many companies will need to take immediate steps to ensure required reporting will be timely, accurate and readily available with all submissions potentially being subject to audit.

According to Corporate Compliance Insights, 2022 will be a pivotal year for ESG reporting. They noted that in early 2021, the U.S. Securities and Exchange Commission proposed rules for mandatory reporting relating to several key areas of ESG, including climate change, human capital management, board diversity and cybersecurity risk governance. However, these proposals resulted in a bit of an uproar, with important issues being intensely debated regarding the SEC’s jurisdiction for these mandates and how the concept of materiality would be treated. With the passing of the Inflation Reduction Act of 2022 this is no longer just a proposed rule but a reality. The legislation included Senator Markey’s (D-MA) provisions to create a first-of-its-kind climate bank that will invest in disadvantaged communities, provide funding for environmental justice mapping and community engagement, support local air quality monitoring, and institute a brand-new production tax credit for offshore wind technologies made in the United States. The package that was passed also includes the following provisions:

- Sec. 60103: Greenhouse Gas Reduction Fund, $20 billion for general climate bank activities, including $8 billion specifically targeted for disadvantaged and low-income communities, matching the National Climate Bank Act.

- Sec. 60201: Addressing urban heat islands, extreme heat, community air monitoring, reducing indoor toxics with the $3 billion environmental justice block grants, similar to Preventing HEAT Illness and Deaths Act, the Environmental Justice Air Quality Monitoring Act, and the Get Toxic Substance Out of Schools Act.

- Sec. 60105: $3 million for air quality sensors in low-income and disadvantaged communities, as called for in the Environmental Justice Air Quality Monitoring Act.

- Sec. 60401: $32.5 million for mapping efforts at CEQ, to help fulfill the Environmental Justice Mapping and Data Collection Act.

- Sec. 13102 (h): new tax credit eligibility for energy-efficient electrochromic glass to lower building energy use, based on the Dynamic Glass Act.

- Sec. 40004: $150 million for extreme heat/weather monitoring, forecasting, and communication of weather information at NOAA, similar to components of the Preventing HEAT Illness and Deaths Act.

- Sec. 70002: $3 billion for USPS clean vehicles, which Senator Markey requested in a letter to Postmaster General Louis DeJoy.

- Sec. 50151: $2 billion in loans for transmission facility financing, which could build the lines called for in the CHARGE Act.

- Sec. 50152: $760 million for grants to facilitate the siting of interstate electricity transmission lines, as called for in the CHARGE Act.

- Sec. 50153: $100 million for interregional and offshore wind electricity transmission planning, modeling, and analysis. This would help allow the development of offshore wind and build out transmission networks called for in the CHARGE Act.

- Sec. 60501: Neighborhood Access and Equity Grant Program — $3 billion for grants to improve walkability, safety, and affordable transportation access, mitigate impacts of surface transportation facilities, and planning and capacity building activities in disadvantaged and underserved communities. Identification, monitoring, and assessment of ambient air quality and transportation-related air pollution is also eligible under this program. These programs are contained in Senator Markey’s Complete Streets Act, Environmental Justice Air Quality Monitoring Act, and Connecting America’s Active Transportation System Act.

It is important to note that in July 2021, it was announced that the Global Reporting Initiative (GRI), one of the leading global ESG standard organizations, was working in cooperation with the EU on the initial stages of the standards being developed and we will need to wait to see what develops as a result in the upcoming years.

This year’s priorities specifically focus on: (i) private funds; (ii) environmental, social and governance (“ESG”) investing; (iii) standards of conduct, including Regulation Best Interest (“Reg BI”), fiduciary duty and Form CRS; (iv) information security and operational resiliency; and (v) emerging technologies and crypto-assets (collectively, the “Significant Focus Areas”). This year the SEC also announced the creation of a Climate and ESG Task Force in the SEC’s Division of Enforcement. The Climate and ESG Task Force identifies ESG-related misconduct and one of its initial areas of focus is to review climate risk disclosures and identification of any material gaps or misstatements under existing rules. Additionally, the SEC has increased its activity, scrutinizing climate-related claims and forward-looking statements made by companies and bringing actions against companies for noncompliance with previously-stated ESG commitments. The SEC’s Acting Director of Enforcement has also warned that, in addition to increased scrutiny of funds advertising green investments, the public should expect more general ESG disclosure-related enforcement actions.

Corporate governance is already taking center stage in the EU this year. Reuters reported in January that large banks in the EU will have to show how they help or hinder the bloc from meeting climate goals by publishing “pioneering” indicators beginning in 2024. Additionally, the European Banking Authority (EBA) set out environmental, social and governance (ESG) templates for the top 150 banks such as Deutsche Bank, SocGen and UniCredit to complete each year. This will allow investors to compare each bank’s exposure to polluting and environmentally-friendly companies and monitor how fast lenders shift to more sustainable business models.

They also note that:

- The EBA said the templates will cover core banking books which include loans.

- Beginning in 2023, banks will have to disclose their exposure to carbon intensive activities and assets that may experience risks like floods and fires as a result of climate change.

- They will also have to provide details on their exposure to fossil fuel clients, on the greenhouse gas emissions they finance, and on alignment with 2050 net zero goals.

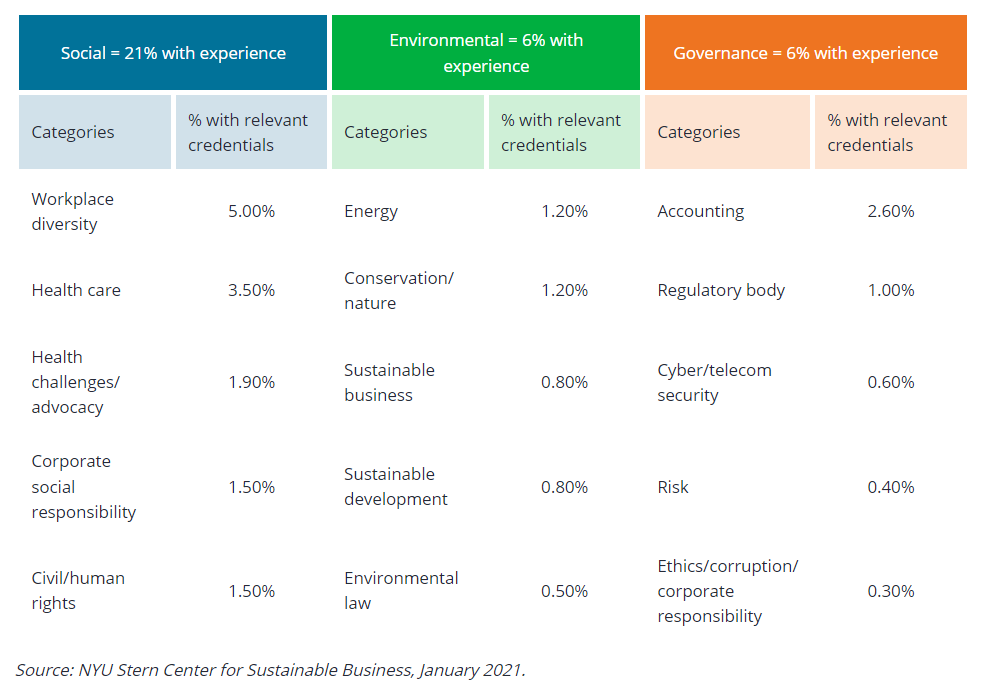

NYU’s analysis of Fortune 100 board directors (above) shows an overall lack of credentials in ESG matters. This begs the question of how credible corporate governance is as a mechanism to solve societal problems like climate change. How an organization assesses its ESG-related risks will also come under review – should they be considered independent to more traditional financial measures or integral to all aspects of company management? This will definitely be a topic of conversation into the future.

There’s no doubt that ESG will remain a massive topic in 2022 and will only be increasingly important for individuals, legislators and businesses, and the momentum will only continue to build as countries around the world experience record shattering extreme and severe weather events most of which is being blamed on carbon emissions and unsustainable business practices.

There is increasing evidence of the link between ESG and financial performance as better data quality, standardized data, longer data history, and heightened interest in assessing the materiality of ESG drives continued research. However, there is already considerable evidence to suggest that the “G” aspect of ESG ultimately yields better corporate returns.

ESG’s integration into reporting and disclosure continues to proceed rapidly, and having a defined ESG plan and governance structure is increasingly an expectation rather than an exception, particularly for large public companies. Boards will likely need to adjust their oversight to accommodate these changes and meet the requirements of regulators, investors, and other stakeholders.

As the focus on ESG continues to evolve and increase so is Weather Source’s focus on this area. Our recently established Climate Risk Enterprise Group was formed specifically to deliver guidance around potential mandates and compliance issues providing climate risk intelligence to businesses, helping them to mitigate risk around weather and climate related issues.

Weather Source is actively developing climate risk intelligence products and services collectively known as the Climate Intelligence Platform (CIP). Whereas our OnPoint Weather Product Suite delivers a wealth of accurate and actionable global weather data down to hyper-local points of interest, the CIP will provide critical climate risk intelligence to support businesses and organizations as they navigate evolving climate risks and opportunities years and decades into the future. These fundamental projections of climate are based on the IPCC, CMIP5, and CMIP6 climate modeling runs which have been analyzed by a team of climate scientists to show the most plausible climate change probabilities.

In conjunction with our parent company Pelmorex Corp./The Weather Network, we have set a high bar by using our breadth of knowledge of historical weather teamed with current climate conditions to build cutting-edge products and solutions allowing us to be a key consultant relating to climate trends, mandates and compliance requirements moving into the future. This group will provide the groundwork for understanding and measuring the probability of weather phenomena across the globe for businesses in all industries.

Is your business prepared? If you aren’t sure or have questions, talk to us about how we can help your business navigate these uncharted waters.