The recent conclusion of the World Economic Forum Meeting in Davos leaves much to ponder. What broader implications does it carry for you and the world?

Annually, leaders across diverse fields convene in the Swiss town to deliberate global challenges and chart paths forward. Criticized for its elitism and costliness, the Davos summit remains pertinent, providing insights into how the affluent and influential respond to critical issues.

Although this year’s theme centered around “Rebuilding Trust,” the focal points from the previous year, spanning global inflation, climate change, and globalization, have shifted to more immediate concerns like the global economy, the climate, China, the Middle East, and Ukraine and even AI.

Let’s look at some of the key takeaways and what we can expect as we move forward into 2024.

Global Economy

Concerns persist about the world economy, as global bank leaders express unease about inflationary pressures. Their worries are linked to the potential for rising oil prices and heightened shipping costs, particularly in light of ongoing issues in the Red Sea. Reuters has reported that bank executives fear the market has inaccurately priced in potential interest rate cuts, anticipating further volatility due to geopolitical risks.

While private discussions among executives have touched on European Bank consolidation, no significant developments have emerged. The lack of progress is attributed to the impracticality of cross-border mergers “without uniform regulation across the region.” A more viable option seems to be selective mergers involving key national players.

Central bankers, including Christine Lagarde from the European Central Bank and Swiss National Bank President Thomas Jordan, along with 1,600 business leaders at the WEF, were confronted with a challenging global economic scenario characterized by mediocre growth, high interest rates, political risks, pandemic after-effects, and mounting debt according to The Swiss Times.

They also noted that in the wake of the emergency rescue of major Swiss bank Credit Suisse by its competitor UBS, UBS CEO Sergio Ermotti addressed the question of the banking sector’s preparedness for the future. Notable representation also came from US tech companies, with speakers such as Marc Benioff, CEO of enterprise software specialist Salesforce, Microsoft CEO Satya Nadella, and Alex Karp from data analysis company Palantir.

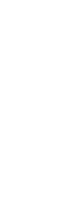

Climate

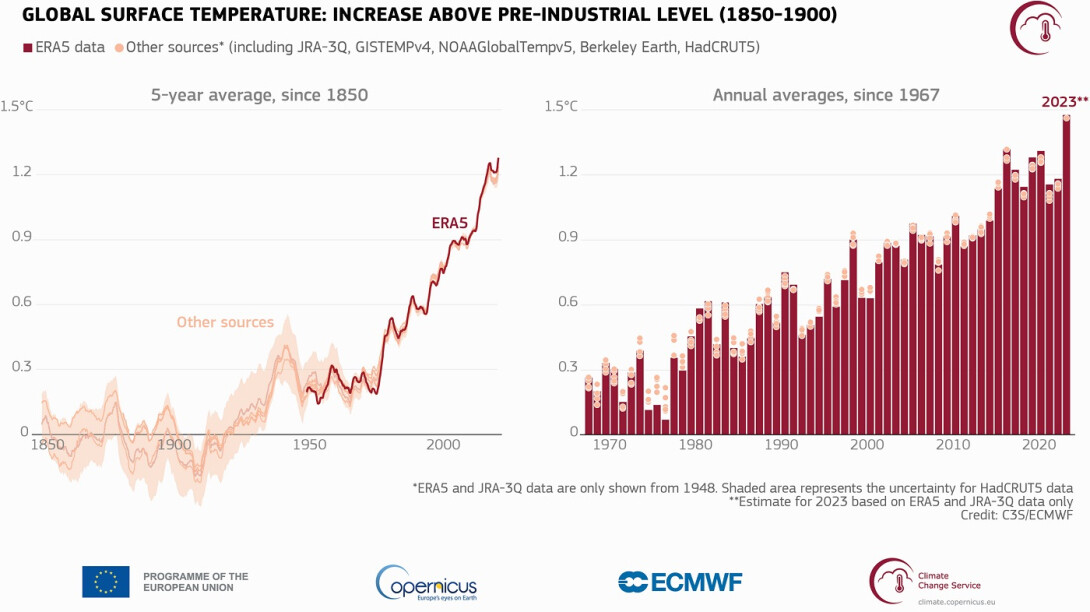

The Forum’s Global Risks Report 2024 finds that environmental risks make up half of the top 10 risks over the next 10 years, with extreme weather events, critical change to Earth’s systems, biodiversity loss and ecosystem collapse being the top three. A Long-Term Strategy for Climate, Nature and Energy was one of the core themes being discussed in Davos.

UN Secretary-General Antonio Guterres told Davos the phase-out of fossil fuels would not only be essential, but also inevitable – but we must act to ensure a just and equitable transition to renewables.

The imperative for businesses to adapt to climate change and global collaboration against it were key topics at WEF. Ajay Banga, President of the World Bank Group, stressed the “existential climate crisis” and the urgency needed. Discussions emphasized the long-term benefits for businesses adopting sustainability and the vital importance of effective resource allocation. Belgian trade unionist Luc Triangle urged developed nations to finance climate action in developing countries to prevent growing inequality. Rebuilding trust, he argued, must extend beyond a select few countries to include the entire world.

Artificial Intelligence

At this year’s WEF meeting, Artificial Intelligence (AI) took center stage, with discussions on its transformative potential for human welfare. Alongside the recognition of its benefits, there were concerns about the necessity for regulation, fears of job displacement, risks related to impersonation and misinformation and the potential exacerbation of inequalities.

This sentiment found expression in Sam Altman, CEO of OpenAI, who, just a few months ago, had been raising alarms about the “risk of extinction from AI.” Altman conveyed, “Humans know what other humans want. Humans are going to have better tools. We’ve had better tools before, but we’re still very focused on each other,” as reported by the WEF’s website in Davos.

China, the Middle East, and Ukraine

In the face of an economic slowdown, China sought increased Western investment, with a 5.2% GDP growth in 2023. Despite U.S. attempts to isolate China, particularly in the semiconductor trade standoff, the country’s open-for-business approach was emphasized at Davos. Ian Bremmer highlighted China’s economic challenges, but the 3-4% growth is still significant for many in the World Economic Forum, as Premier Li Qiang reassured the economy’s openness for foreign investment amid cautious investor sentiments.

Ukraine’s Zelensky was on hand aiming to position Ukraine as a cornerstone in the defense of democracies. Zelensky worked to keep his country’s long and largely stalemated defense against Russia on the minds of political leaders, as Israel’s war with Hamas, which passed the 100-day mark this week, siphons off much of the world’s attention and has sparked concerns about a wider conflict in the Middle East, according to the AP.

Reuters reported that the leader of the Palestine Investment Fund projected a minimum of $15 billion for Gaza’s housing reconstruction. However, Arab states indicated they wouldn’t contribute to rebuilding without enduring peace. Prince Faisal bin Farhan, Saudi Foreign Minister, emphasized the need for Palestinian statehood as a prerequisite for regional peace, including peace for Israel, during a WEF panel.

With all of that being said, there are a multitude of factors, along with potential risks, that will influence the global economy in 2024 and beyond.

Heads of global banks continue to warn of inflationary pressures from increased shipping costs and the possibility of oil price rises. Bank executives fear the market is mispricing interest rate cuts, and that geopolitical risks could cause volatility.

“It’s a big year in general with many elections around the world which could potentially change the way fiscal stimulus is handled around the globe,” said Suni Harford, President Asset Management and Group Executive Board Lead for Sustainability and Impact at UBS.