There are several ESG Factors that can affect a company’s credit risk assessment with the environment being one of the most critical. S&P Global recently published a blog series called ESG and Credit Risk Analysis, discussing how environmental, social, and governance (ESG) factors are becoming important considerations when assessing the credit risk of different industries and companies across the globe.

As the ‘E’ in ESG stands for Environment – S&P analyzed how the natural environment in which a company operates can influence its credit profile. This analysis involves two entities: 1) a review of the potential impact natural events and conditions may have on a business activity; and 2) an assessment of the natural resources used by an entity (the waste and polluting gases produced), and how these factors may ultimately impact an entity’s reputational, legal, and regulatory risks and costs.

Severe and anomalistic weather events, such as storms, earthquakes, tsunamis, floods, and wildfires, can mire the progress of construction, disrupt supply and distribution chains, and defer production, all of which negatively impact operational and financial performance of a business, along with levels of capital and liquidity.

As the instances of severe and anomalistic weather events increase in severity, duration and frequency, environmental-related risks are increasingly affecting credit risk and corporate failures as well, and one of the main challenges for businesses today is to transform environmental factors from risks and costs into opportunities and benefits. Access to advanced weather and climate data enables companies to document trends as well as to identify and quantify the impact of impending anomalies and their potential business impacts and risks.

Höck, A., Klein, C., Landau, A. et al. in their abstract The effect of environmental sustainability on credit risk, came up with to two hypotheses: 1) Companies with higher environmental sustainability have lower credit risk premiums; and 2) Only companies with a high creditworthiness profit from a high environmental sustainability. They note that “moderating effects could provide a link between the risk-mitigation view and the overinvestment view (as shown by Stellner et al. (2015)) for the moderating effect of country sustainability on the relationship between credit risk and sustainability on company level.”

ESG environmental-related risks are among the most significant risks facing businesses today. According to the World Economic Forum’s Global Risks Report 2020, the top five risks in terms of likelihood are all environmental risks (extreme weather, climate action failure, natural disasters, biodiversity loss and human-made environmental disasters), and three of the top five risks by impact are also environmental (climate action failure, biodiversity loss and extreme weather). Integrating ESG risks consistently through existing practices and processes can help risk management and sustainability experts navigate these ESG-related risks.

Environmental ESG causes can be strong environment standards, such as sustainable natural materials, water conservation and CO2 reductions. A recent article from E&Y noted,

“While organizational and board structures vary across companies, strong governance is fundamental to success. Some boards may choose to create a separate sustainability committee or an environmental, health and safety committee to explicitly focus on ESG risks and opportunities. The most effective structure may change based on the company’s circumstances and the advancement of its sustainability journey. Integrating ESG risks consistently through existing ERM governance practices and processes can help risk management and sustainability practitioners navigate these accelerating ESG-related risks.”

This information reinforces the need for ESGs to become more focused on weather and climate data, specifically, long-term climate models as well as increasing focus on long-term renewable projects. Companies can utilize tools such as OnPoint Climatology, to understand how weather is departing from the climatological “norm” and how this “departure from normal, particularly if recurring, can affect their risk. This, in turn, will help them mitigate weather risk in the long term and become more sustainable with the end result being be a lower credit risk. Climatology is the statistics of weather over time and the Weather Source OnPoint Climatology data product includes not only the mean, but also standard deviation and frequency of occurrence data.

In addition to identifying anomalistic weather, OnPoint Climatology can also be used as a long-range forecast tool. Weather Source climatology data seamlessly integrates into any company’s business analytics to discover how consumers or businesses respond during “normal” or “average” conditions, and more importantly, how they respond during “departures from normal.” Often, departures from normal have the biggest influence on consumer behavior and businesses and pose the greatest risk.

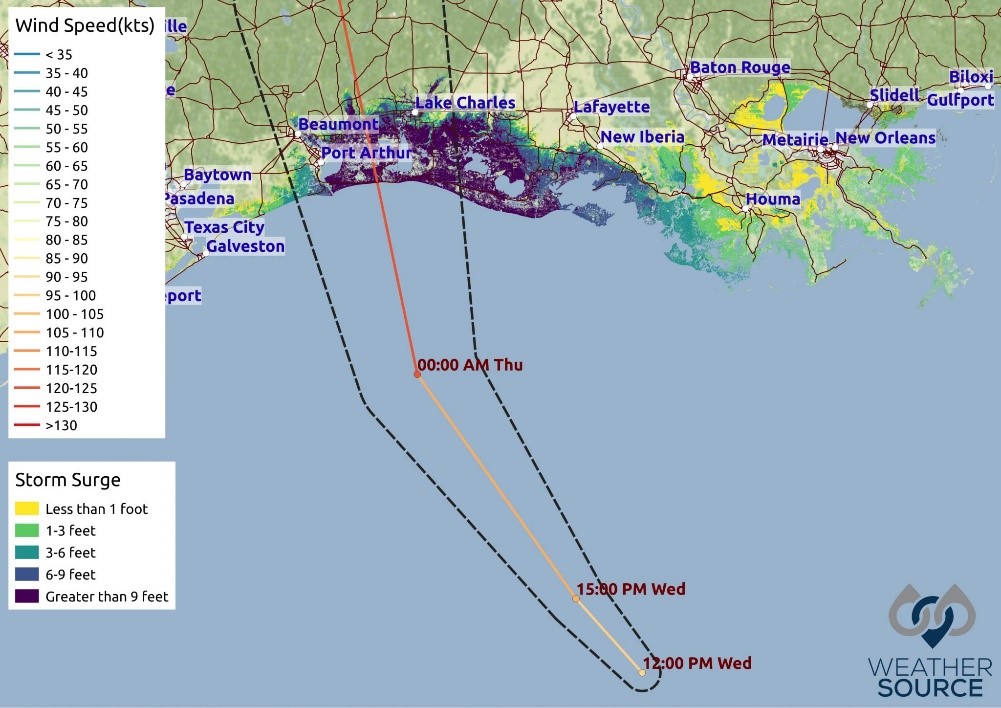

Additionally, by using OnPoint Climatology in tandem with OnPoint Geospatial, companies can effectively visualize weather and climate trends. For example, geospatial products can illustrate the departures from normal or what path a hurricane took on a particular day or where (in a region) people will be affected by certain temperatures. Geospatial products can incorporate deep, historical data with present and forecast data to provide powerful insight for evaluating risk.

A sample image of OnPoint Geospatial, showing the path of a hurricane in the Gulf of Mexico.

Assessing long-term climate risk is advantageous over sustainable investments that don’t pay out right away, and do not have same returns. Contact us today to learn more about Weather Source’s OnPoint Geospatial and OnPoint Climatology products and the rest of the OnPoint Weather Product Suite.