Is the snow getting you down? Or does a sunny day put you in a great mood? The weather can affect us personally in many ways. But it can also affect our money – and even the stock market.

According to Forbes1, company profits, the competitive landscape, cash flow, management teams and more, are considered by professional investors when determining how to value stocks. But they have found that more goes into those decisions. Traders can also be affected by weather and, ergo, they could feel more inclined to buy stocks on sunny days and push prices higher or sell stocks on dreary days, causing prices to fall.

Tyler Shumway and David Hirshleifer decided to delve into this further and authored a research paper titled “Good Day Sunshine: Stock Returns and the Weather.”2 Their goal was to answer: To what extent do transitory moods or emotions affect markets.

Shumway noted that in the field of behavioral finance, research showed that a person’s emotions may influence decisions at times. Additionally, other research has found relationships between weather and market performance.

The Correlation with Commodities

Michael Hadden, Investment Research Analyst talked about this in an article for CLS Investments.3 He also believes that weather can affect investments, specifically agricultural commodities. In particular corn prices, he noted that this past spring (2019) the Nebraska area experienced a significant amount of flooding. As a result the overall wet weather across the Corn Belt significantly slowed planting season, lower yields and higher prices.

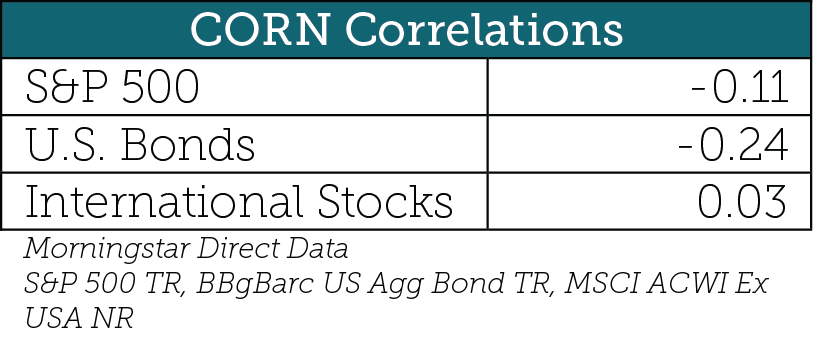

He mentioned, there is a great investment thesis for corn and the expectation for higher prices, but corn and other commodities may also make sense in the longer term. He cites the table below where CORN is negatively correlated to both U.S. stocks (S&P 500) and bonds (Bloomberg Barclays U.S. Aggregate Bond Index) and has nearly no correlation to international stocks (MSCI ACWI ex U.S.).

Although some remain skeptical, making investment decisions around weather events can be complicated. However, according to Sumway, it is important to recognize how the behavior of others may affect your portfolio. Market investors do not always act rationally.

The Misuse of Climate Data could be a Threat to Business and Financial Markets

Finally, findings published in the journal, Nature Climate Change, calls on businesses, the financial services industry and regulators to work more closely with climate scientists.4

Domestic and international regulators and governments are increasingly demanding that businesses assess and disclose vulnerability to the physical effects of climate change, for example, increased drought, bushfires, and sea level rise.

In the article lead author Dr. Tanya Fiedler from the University of Sydney Business School said “People are making strategically material decisions on a daily basis, and raising debt or capital to finance these, but the decisions may not have properly considered climate risk.” Dr. Fiedler went on to say “as with any form of decision-making, businesses could be operating under a false sense of security that arises when non-experts draw conclusions believed to be defensible, when they are not.”

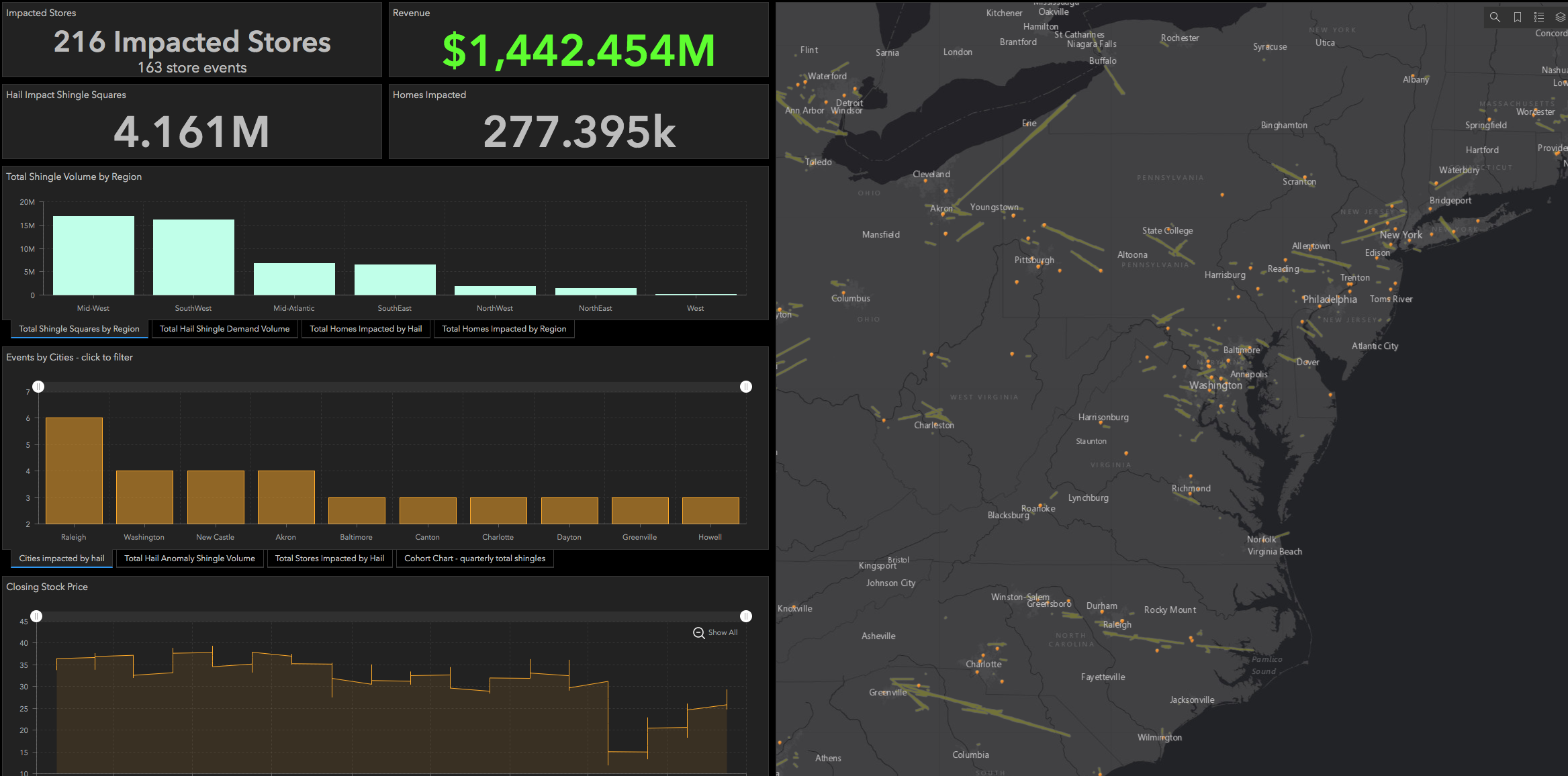

For example, a Weather Source client, a significant hedge fund with a position in agricultural commodities uses Weather Source data to monitor evolving temperature and precipitation anomaly trends as well as forecasted anomaly trends. This empowers the fund to quantify the impact on commodity futures and optimize its trading positions.

The sample Weather Source image above outlines hail damage that directly correlates to revenue impact.

Weather Source has several tools that seamlessly manage the complexities of ingesting, cleansing, and delivering weather and climate data for business intelligence. OnPoint Weather and OnPoint Climatology provide hyper-local solutions that can be tailored to points of interest most relevant to your business.

Weather Source ingests all available weather inputs, unifies them under our intelligent code, and resolves issues related to geography, topography, and elevation to deliver accurate predictions at any point on Earth. OnPoint Climatology is also useful as a long-range forecasting tool. Using our cutting-edge climatological technology, Weather Source is able to provide accurate forecasts of up to 15 days with an enhanced and extended forecast out to 42 days.

Weather is also in active development of its Weather Impact Management System (WIMS). The and a number of and a number of Weather Impact Indices that are related to various industries and consumer behavior. WIMS application automatically determines the relationship (i.e., as described through “Insight Features”) between weather, climate and a target variable (e.g. Application ingests customer transaction data and historical Weather Source weather and climate data for training and testing of models with the goal of predicting specified target performance related to recent and/or forecasted weather to provide “Insight Features” for the target.

Sources: